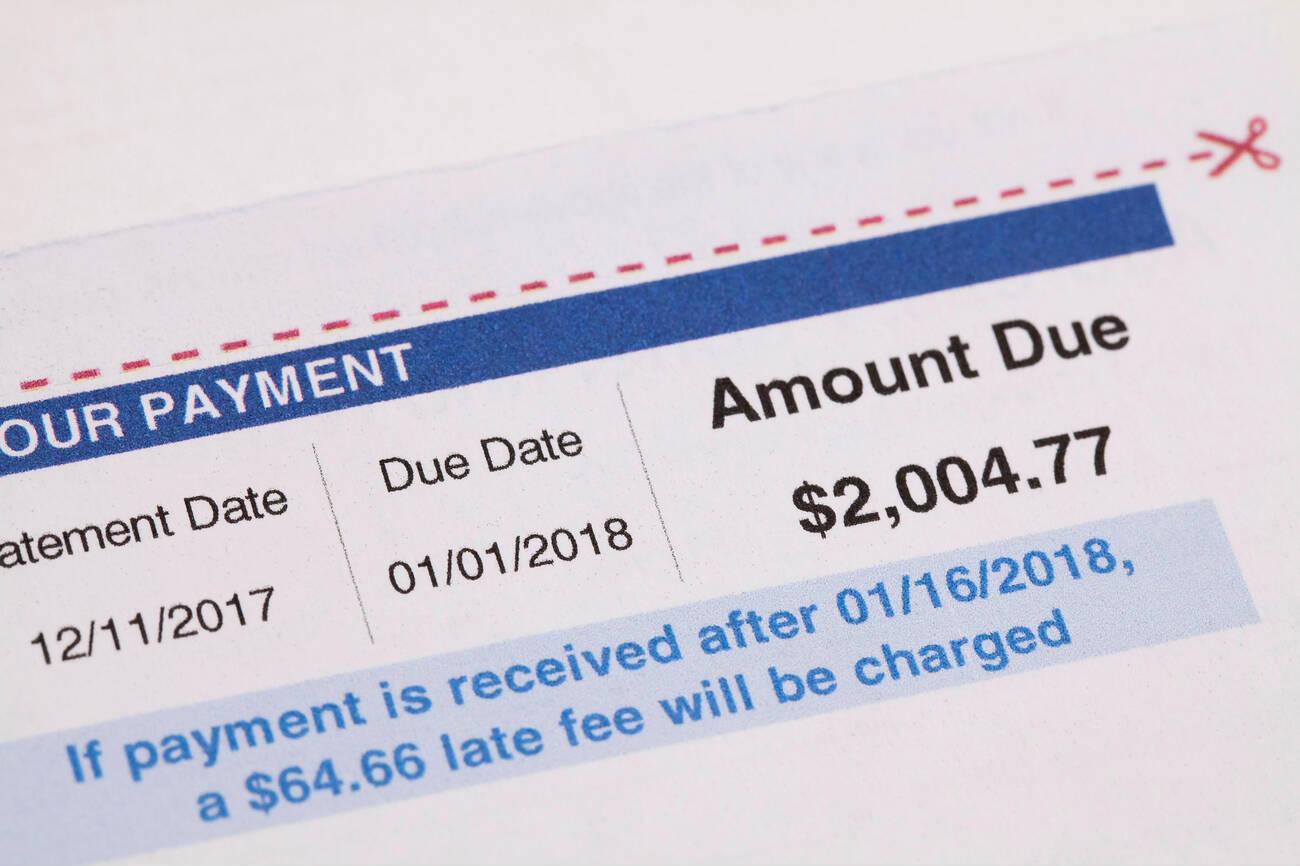

Certain can cost you need to be paid upfront through to the loan is approved (or rejected), and others implement annually

Interest levels and you may Costs

Interest rates on commercial loans are generally more than towards the home-based finance. In addition to, industrial a house fund usually cover charge one enhance the total cost of your loan, also assessment, courtroom, application for the loan, mortgage origination, and/otherwise questionnaire costs.

For example, that loan could have a one-go out financing origination fee of just one%, due during closing, and you will an annual percentage of a single-one-fourth of a single % (0.25%) before the financing is totally reduced. A beneficial $one million loan, such, may require a-1% loan origination percentage comparable to $10,000 as reduced initial, that have an excellent 0.25% payment regarding $dos,five hundred paid off a year (as well as appeal).

Prepayment

A professional mortgage have constraints to the prepayment, designed to maintain the latest lender’s anticipated give for the financing. In the event your traders accept the debt till the loan’s readiness date, they have in all probability to invest prepayment charges. You can find four primary variety of exit charges having paying off that loan very early:

- Prepayment Punishment. This is basically the simplest prepayment punishment, determined by the multiplying the modern an excellent balance by the a specified prepayment penalty.

- Desire Make certain. The financial institution try eligible to a specified level of desire, even when the loan are paid very early. Such, a loan could have a beneficial ten% interest secured to own sixty months, with an effective 5% get-off percentage up coming.

- Lockout. This new debtor do not repay the loan just before a designated months, such as for example an effective four-seasons lockout.

- Defeasance. A replacement away from guarantee. In place of spending cash towards the lender, the brand new debtor transfers the brand new security (constantly You.S. Treasury securities) on brand new financing collateral. This will reduce charge, however, higher penalties might be attached to this process out-of using out of that loan.

Prepayment terms and conditions is actually recognized about loan documents and certainly will be negotiated along with other loan terminology from inside the commercial a house funds.

Its fundamentally best if you want a credit score off 620 or more to own a professional real estate loan. If your rating is leaner, you will possibly not be acknowledged for one online payday loans Oregon, or the interest rate in your mortgage would-be higher than mediocre.

The expression from a commercial loan may differ with respect to the mortgage it is generally less than a domestic loanmercial money can feel any where from five years or faster to two decades. There are also micro-perm financing getting commercial functions that will work with for a few so you can five years.

Not necessarily. All mortgage and each borrower varies. Some loan providers may require equity for a professional loan although some may well not. It depends for the regards to the loan as well as the borrowing from the bank character of your debtor.

The bottom line

Having commercial a residential property, a trader (commonly a business organization) instructions the home, apartments away area, and you may gathers book in the businesses that work into the assets. The latest financing is intended to be an income-creating property.

When researching industrial home loans, lenders look at the loan’s equity, the fresh creditworthiness of the entity (or principals/owners), in addition to 3 to 5 many years of financial comments and you will taxation yields, and you may financial percentages, such as the financing-to-really worth ratio while the obligations-provider visibility ratio.

Home-based financing are amortized along the longevity of the borrowed funds therefore that financing was fully repaid at the end of the newest mortgage label.

A lower life expectancy DSCR ortization symptoms and you will/or functions that have steady bucks flows. Highest rates may be needed getting features having volatile dollars circulates-such as, rooms, and this lack the much time-name (hence, significantly more foreseeable) occupant accommodations common some other types of industrial a residential property.