2. Money end in less than 36 months (retirement)

Buy a home with resource income

Funding funds can be used to qualify for a home loan. But loan providers most likely wouldn’t amount an entire advantage amount. Whenever senior years profile consist of brings, securities, otherwise common money, loan providers is only able to explore 70% of one’s property value those people account to choose how many distributions continue to be.

Pick a property which have an excellent co-signer

Particular retired moms and dads are doing so it adding its youngsters or a family member on the financial application. A child which have reasonable money can be considered with the mother or father, letting them purchase a house even with zero typical bucks move.

Federal national mortgage association have an ever more popular brand new financing system having co-signers. This new HomeReady mortgage program lets money away from non-borrowing from the bank family, for example mature children otherwise family relations, to-be measured.

To qualify for HomeReady, you ought to meet with the income restriction standards and get an initial home. Vacation residential property and you may financing attributes are not acceptance.

Assets income tax breaks getting the elderly

One to final thing to adopt as a senior homeowner is that you can even qualify for a house tax split. Regulations so you’re able to claim your own elderly possessions income tax exclusion are very different from the county. Therefore does the amount the taxes is less. Consult your regional taxation power otherwise financial coordinator to get more information.

Being qualified for reduced a property taxes may help reduce your loans-to-money ratio (DTI). Having a lesser DTI ount you might borrow secured on the new mortgage.

Recall, even if you be eligible for income tax vacations, taxes will be computed from the most recent income tax rates installment loans online in Washington throughout the local area, states Jon Meyer, financing pro.

Home loan challenges getting retirees and you will the elderly

Since there is no restrict age restriction to try to get a mortgage, seniors and retired people could find it more challenging in order to be eligible for an excellent financial.

Mortgage organizations need verify that you could pay back property mortgage. Constantly, that implies deciding on monthly money centered on W2 tax forms. But most seniors will not have a frequent monthly income so you can show lenders.

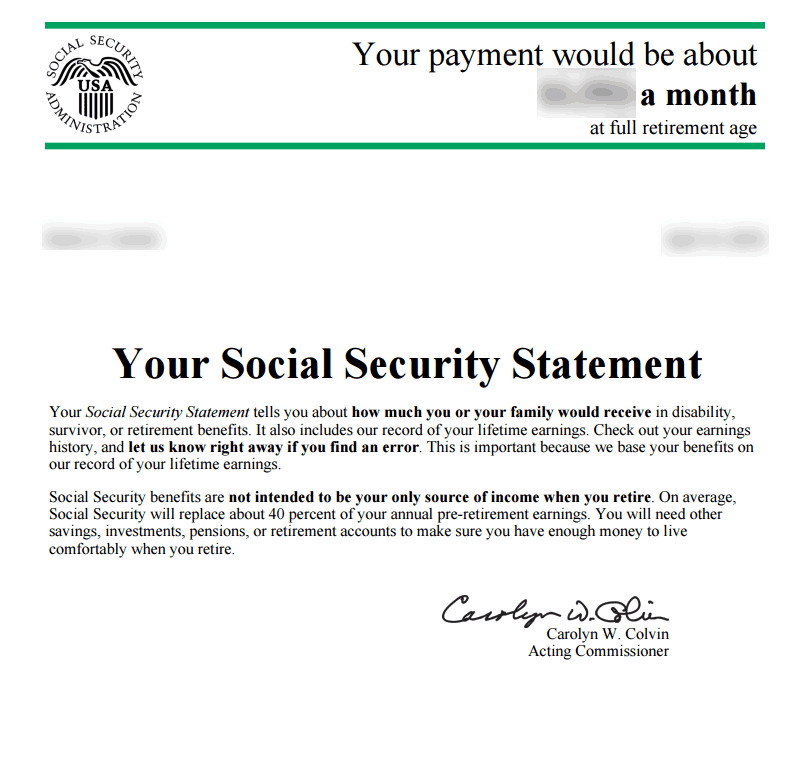

Of these during the senior years, loan providers can sometimes think 401(k)s, IRAs, and other old age membership distributions to possess home loan being qualified. They’ll contemplate Public Defense money, your retirement, and you may capital earnings.

But not, consumers need certainly to confirm these fund try completely offered to all of them. You simply cannot meet the requirements predicated on old-age profile otherwise your retirement unless you is also mark from their website in the place of punishment.

Retired people should also tell you their old age levels may be used to pay for a mortgage, near the top of typical life costs such as for instance food and tools.

Homebuyers who aren’t yet , retired, but decide to retire soon, will get struck a different snag on mortgage app techniques. After you get a home otherwise refinance, mortgage lenders must be certain that your earnings resource will continue for about 36 months adopting the mortgage shuts.

Some body retiring inside a year or several wouldn’t see so it continuing income criteria. Therefore, they would not be eligible for a mortgage or refinance loan. It will not count exactly how highest its credit history was. Nor can it count exactly how much personal credit card debt they’ve got paid back from. Or the amount of money they have stashed away inside the assets and you may later years accounts.

- Nothing is on the shell out stubs so you’re able to cue a lender off regarding old age plans, so they really enjoys all reason to believe your income is going to continue

- There is zero ensure that you are going to retire whenever arranged. We change their agreements in line with the current savings, its financial investments, otherwise the want to keep going

When you’re in times where you gotten a pension buyout otherwise your employer says to their financial on the retirement preparations, you will possibly not manage to be eligible for another type of financial. Should this be your situation, you may have to hold back until you have resigned and you can begun attracting from your old-age membership so you’re able to be considered based on their assets alternatively than just your revenue.